వ్యాసం: Pricing Studded Stones @ Gold Rate : A Simple Logical Explainer

Pricing Studded Stones @ Gold Rate : A Simple Logical Explainer

Why Stone‑Studded Gold Jewellery Is Priced at the 22k Gold Rate (And Why That’s Fair)

In handcrafted jewellery, the cost of tiny embedded stones isn’t the stone itself—it’s the goldwork and labour needed to set hundreds of them securely. Pricing the studded portion at the 22k gold rate fairly recovers real craft costs without inflating “making charges,” and it aligns with our buyback promise.

Making Charges Depend on “Value Addition” (Apples ≠ Oranges)

Not all gold jewellery needs the same labour. Plain, low–value‑addition pieces (e.g., machine‑made chains, bangles) typically carry ~10–12% making. But high value‑addition pieces—like stone‑studded, hand‑set, highly carved jewellery—naturally require more artisan time, skill, risk and finishing, so making charges are higher.

Two Kinds of Stones, Two Ways of Pricing

We use freshwater seed pearls and precious gems such as rubies, emeralds, sapphires, turquoise, and coral in two distinct ways:

-

Studded (embedded) stones — tiny accents set into the gold (prongs, bezels, kundan, etc.).

How we price: at the 22k gold rate per gram (explained below). -

Hanging / stringing beads — strands or tassels tied with gold wire or fabric (chokers, rani haars, jhumka hangings).

How we price:- Ruby / Emerald / Sapphire beads at ₹150 per carat

- Freshwater pearls at ₹350 per gram

We apply 18% making charges on the 22k gold value only (not on stones/beads), and GST @ 3% on the pre‑tax total. We do not add a separate wastage line—those costs are already priced in.

Why Studded Stones Are Charged at the 22k Gold Rate

1) Handcrafted workflow = real value already added in gold

Our process is fully handmade and multi‑stage. The gold base is built first, and each artisan is paid as a % of output weight at their stage. For example:

- Start at 20 g → Step 1 finishes at 22 g (labour paid on 22 g)

- Step 2 → 35 g (labour paid on 35 g)

- Step 3 → 36 g (labour paid on 36 g)

By this point, meaningful labour value is embedded in that gold.

2) Stone setting removes metal (and sinks cost temporarily)

When the setter begins, they handpick, say, ~400 tiny stones (~3 g) and drill seats/holes into the gold. This removes metal. A typical incomplete 36gram piece can see ~15 g of 22k gold removed to create those seats.

- That 15 g is 22k gold we already paid labour on earlier.

- Once removed (filings/offs), it can’t be reused immediately. We must accumulate ~100–200 g, then melt/refine it back for production. This takes days to weeks, tying up working capital and “pausing” previously paid labour value.

Pricing the studded weight at the gold rate is the fairest, simplest way to recover that sunk value addition and capital timing cost.

3) Keeping making charges reasonable (18%, not 24%+)

Yes, we could raise making to, say, 24% to reflect the extra handwork and risk—but customers often resist higher making. We keep making at a clear 18% and use the gold‑rate method for studded weight to recover the rest transparently.

4) Input stones vary widely—your protection

Small rubies, emeralds, and sapphires have different input prices by size, cut, shape, and grade. As a rule of thumb, we avoid procuring accent stones that exceed the gold rate. Therefore, charging studded weight at the gold rate won’t disadvantage you versus our stone inputs.

5) Buyback logic that favours the customer

We guarantee buyback of the studded portion at the prevailing 22k gold rate if you sell back to us, because we can reuse these accents efficiently. Historically, precious stones have tended to rise with gold, which keeps this policy both fair and sustainable.

A Simple Thought Experiment

Imagine you buy a 100 g gold chain and pay 6% making. You go home and grind off 30 g from the chain. You still “have” 30 g of gold, but can you now sell the remaining 70 g chain to someone else at the same 6% making? Obviously not. The chain has lost value addition and needs reworking.

That’s exactly what happens in stone setting: the gold we painstakingly built up is partly removed to create stone seats. The lost value addition (and tied‑up capital) must be recovered somewhere—pricing studded weight at the gold rate is the cleanest, most transparent way to do it.

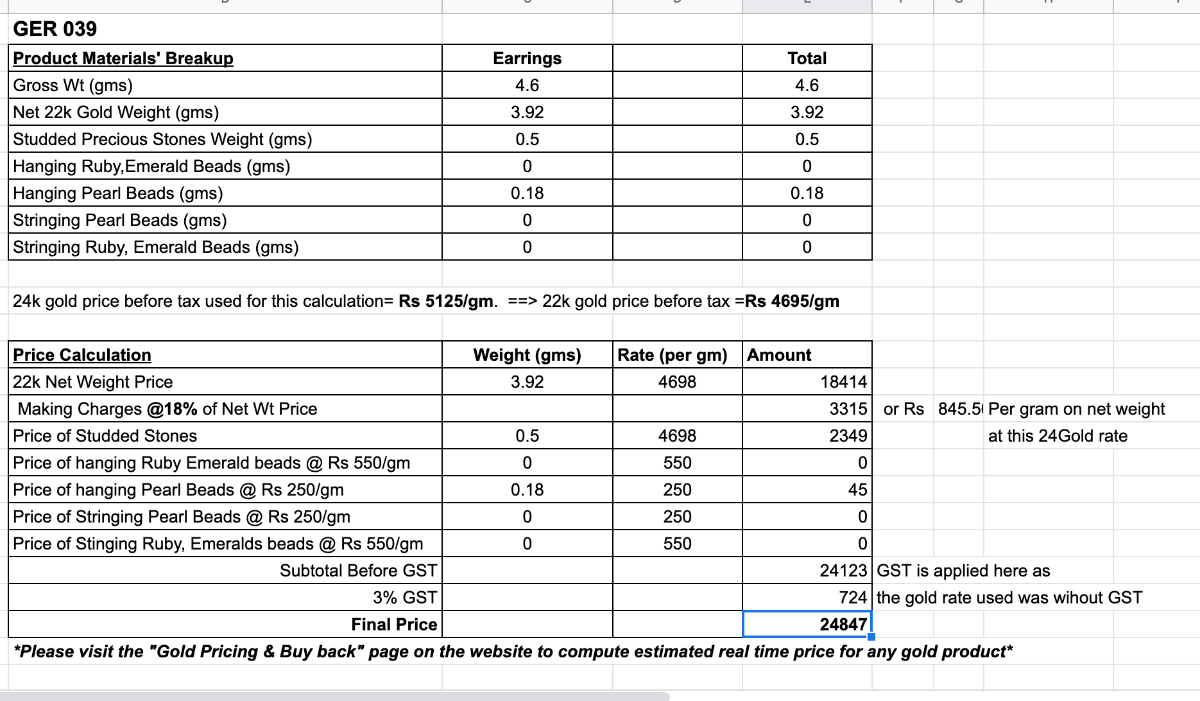

How Your Invoice Reads (At a Glance)

- 22k Gold weight × 22k rate

- Studded (embedded) stones weight × 22k rate

-

Hanging beads

- Ruby/Emerald/Sapphire beads: ₹150 per carat

- Pearls: ₹350 per gram

- Making charges: 18% of gold value only

- GST @ 3% on the pre‑tax total

We could, but customers reasonably question high making rates. Our structure keeps making at 18% and fairly prices the studded portion at the gold rate to reflect real craft work and capital timing—without hidden “wastage” add‑ons.

FAQs

“Am I paying gold price for cheap stones?”

No. For tiny embedded accents, you’re primarily paying for the goldwork: micro‑drilling, seat cutting, precision setting, finishing, and the capital/time cost of removed gold. The gold‑rate method is a simple proxy for that real, handcrafted value.

“Why not price each micro‑stone individually?”

Their prices vary wildly and rarely reflect the dominant cost driver—the setting work. Pricing hundreds of micros individually makes invoices confusing and still wouldn’t cover the sunk value in removed gold.

“What about big, high‑value gemstones?”

Prominent, certified centre stones are priced separately. The gold‑rate method applies to accent stones embedded into the gold.

“Will you really buy back at the gold rate?”

Yes. If you sell back to us, we’ll buy the studded portion at the then‑prevailing 22k gold rate. We can reuse the accents efficiently, and historically precious stones have tracked upwards with gold, so the policy remains fair to both sides.

Bottom Line

Pricing studded weight at the 22k gold rate is not about inflating stone value—it’s about honestly accounting for the craftsmanship, metal removal, and capital timing in handmade jewellery. It lets us keep making charges reasonable, gives you a transparent bill, and backs you with a clear buyback promise.

Featured collection

వ్యాఖ్యానించండి

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.